Nonprofit Compliance Lessons from a Nonprofit Attorney

Nonprofit leaders are resourceful by nature. Many handle their own marketing, event planning, and even grant writing to stretch limited budgets.

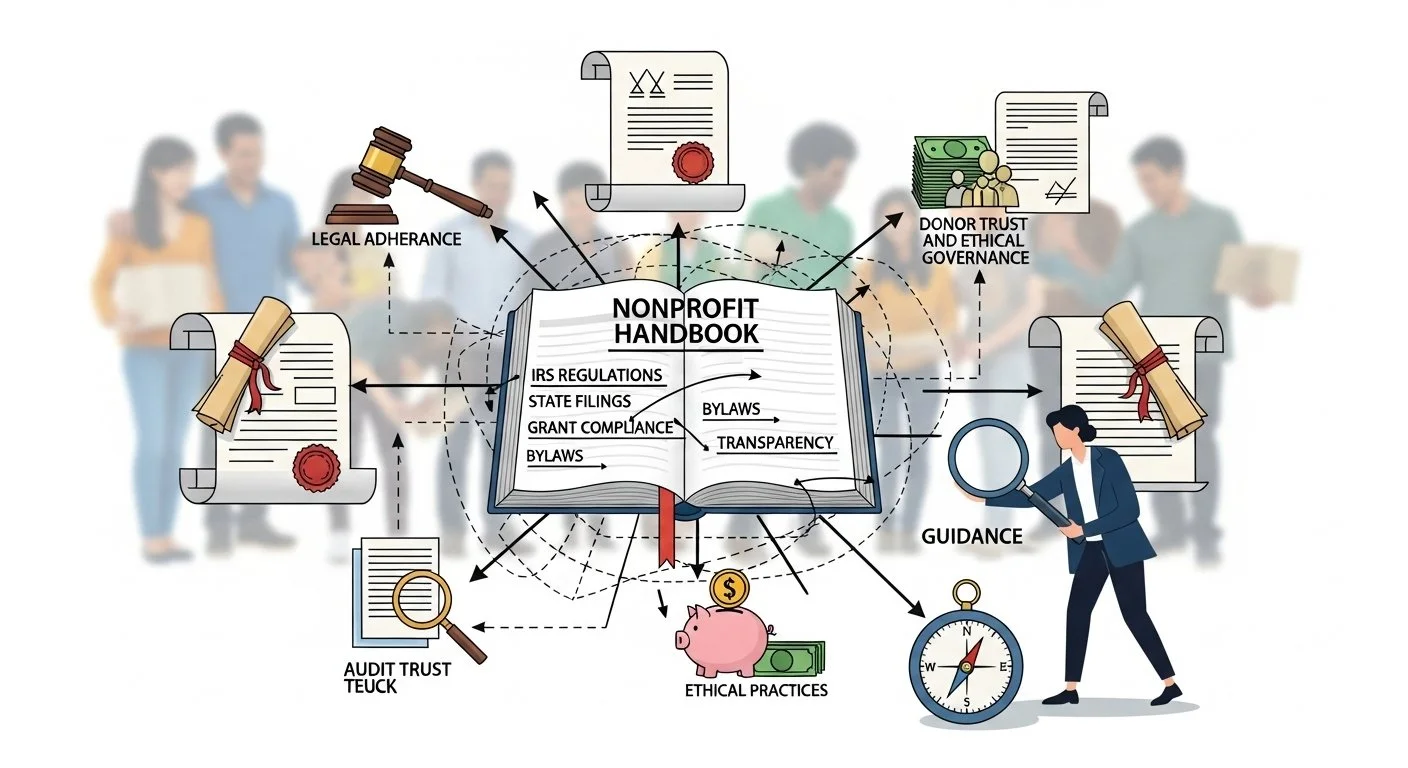

But when it comes to nonprofit compliance, do-it-yourself approaches often create more risk than savings.

Compliance failures don’t just generate extra paperwork. They can result in loss of your nonprofit tax-exempt status, denial of funding, reputational damage, and, in some cases, legal consequences.

To shed light on the most common nonprofit compliance pitfalls, the Nonprofit Fixer asked attorney Morgan Daly, who regularly advises nonprofit organizations on compliance and governance, to share the top four lessons about nonprofit compliance every leader should know.

Disclaimer: Morgan Daly is not your attorney, and this article does not create an attorney-client relationship. The information provided here is for educational purposes only and should not be considered legal advice. Please review the full disclaimer here.

Special Offer: Morgan Daly is offering FREE nonprofit compliance checks through December 31, 2025. This no-cost review helps identify risks before they become costly problems. Click here to schedule your free compliance check.

Compliance Lesson 1: File Nonprofit Taxes Every Year—or Lose Your Status

The most frequent compliance gap we uncover is missed annual IRS filings. After receiving a 501(c)(3) tax determination letter, many organizations assume they’re “done.” In reality, the vast majority of 501(c)(3) organizations are required to submit a Form 990-series return (Form 990, 990-EZ, or 990-N) each year.

The statute is explicit for organizations required to file:

“If an organization fails to file a required annual return or notice for three consecutive years, its tax-exempt status is automatically revoked by operation of law.” (Internal Revenue Code §6033(j)(1))

What revocation actually means: When a nonprofit’s 501(c)(3) status is revoked, the IRS lists the organization on the public auto-revocation list. Contributions made after the revocation effective date are not tax-deductible, which causes major issues for donors and grantors. Some donors or grantors will pause or pull funding. Reinstatement of 501(c)(3) status requires an IRS filing and user fee, and can take multiple months to process.

Morgan Daly explains: “If you’re required to file a tax return with the IRS and miss three consecutive years, revocation is automatic and public. Donors and grantors will face significant issues when filing their tax taxes.”

Compliance lesson: The annual 990-series tax return is not optional for organizations required to file, and most nonprofits with 501(c)3 status are required to file. Three consecutive misses triggers automatic revocation.

Compliance Lesson 2: Adopt and Utilize a Conflict of Interest Policy for Your Nonprofit Organization

A recurring compliance issue for nonprofit organizations is the absence—or non-enforcement—of a Conflict of Interest (COI) Policy. The IRS encourages (but does not federally require) a COI policy, asks about it on Form 1023 and Form 990, and funders routinely request it during due diligence. Many states and institutional funders effectively treat it as expected nonprofit governance.

The IRS describes the policy’s purpose:

“A conflict of interest policy is intended to establish procedures under which individuals who have a conflict of interest will be advised to disclose the conflict and will be prohibited from voting on matters in which they have a conflict.” (IRS Form 1023 Instructions)

Without a COI policy—and consistent annual disclosures—organizations risk governance disputes, appearances of private benefit, and funder concerns, even where no actual wrongdoing occurred.

Morgan Daly cautions: “Funders are sophisticated. If you can’t produce a COI policy and signed disclosures, they’ll question your governance controls—fairly or not.”

Need one now? You can purchase an IRS-aligned Conflict of Interest Policy, Procedure, and Disclosure Form here—on sale for $100 (regularly $499).

Compliance lesson: While not mandated by federal law, a COI policy (with annual disclosures and recusal procedures) is a universal expectation of nonprofit compliance—and protects both the organization and its leaders.

Compliance Lesson 3: Register Your Nonprofit Before You Fundraise

We frequently encounter nonprofit organizations soliciting donations—events, online campaigns, mailers, even grant applications—before completing required state charitable registrations.

Reality check: Most states require fundraising registration prior to solicitation, but requirements and exemptions vary. Some states exempt religious organizations or very small solicitations; thresholds and renewal rules differ. It’s essential to understand the rules of your state and any other states you are conducting fundraising activities in.

For example, Indiana provides:

“No charitable organization shall solicit contributions from persons in this state by any means whatsoever until it has registered with the Attorney General’s office.” (Indiana Code §23-7-8-4)

Consequences of non-compliance can include fines, delayed or withheld grant funds, and reputational damage with donors.

Morgan Daly notes: “I’ve seen five- and six-figure awards frozen because the nonprofit wasn’t properly registered with the state. It’s a one-form problem that can cost you an entire grant cycle.”

Compliance lesson: Treat charitable registration as a legal prerequisite to fundraising. If you fundraise in multiple states (including online), map the rules and register (or claim exemptions) where required.

Compliance Lesson 4: Maintain a Compliant, Independent Nonprofit Board

Many organizations underestimate the importance of board composition and independence when it comes to compliance. State law governs the minimum number of directors—many states require three, while a few permit fewer—and the IRS focuses on independence and active oversight.

When board members resign and aren’t replaced, or when related parties dominate, you invite state compliance issues and funder skepticism.

Morgan Daly warns: “A nonprofit board that’s too small, inactive, or related on paper erodes credibility. Regulators and funders read your 990 tax filings—make sure they tell the right story.”

Compliance lesson: Verify your state’s board of director minimums, keep independence strong, document meetings and votes, and replace vacancies promptly.

Final Word

Nonprofit compliance isn’t glamorous, but it’s important. In initial reviews, we most often find: missed (required) 990-series filings, absent or unused conflict of interest policies, unregistered fundraising solicitation, and boards that don’t meet state or independence expectations.

As Daly emphasizes, “DIY has its place in nonprofit work, but compliance isn’t one of them. The cost of mistakes almost always exceeds the cost of doing it right from the beginning.”

You can schedule a FREE Nonprofit Compliance call with Morgan Daly now through December 31st. Click here to schedule.